steelhorse454

Jet Boat Addict

- Messages

- 199

- Reaction score

- 135

- Points

- 92

- Location

- Cape Carteret, N.C.

- Boat Make

- Yamaha

- Year

- 2023

- Boat Model

- AR

- Boat Length

- 19

Hey Folks-

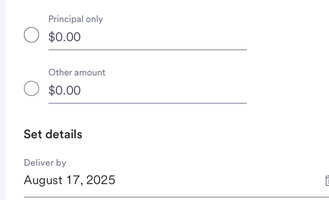

We have not been out much this year due to "life happening events", but today is a great day. The wife and I have been doubling and tripling up on our boat payments, and today, just sent the balance in for payoff. What a great feeling !

Another nice asset in the group with our 2023 AR195, or not, depending on how much of a money pit it may become.. haha.

haha.

Our next trip out with be extra relaxing for sure !!!

We have not been out much this year due to "life happening events", but today is a great day. The wife and I have been doubling and tripling up on our boat payments, and today, just sent the balance in for payoff. What a great feeling !

Another nice asset in the group with our 2023 AR195, or not, depending on how much of a money pit it may become..

Our next trip out with be extra relaxing for sure !!!